Estate Planning

Corporate Transparency Act – Beneficial Ownership Reporting Requirements

Important information related to new beneficial ownership reporting requirements. NOTE: In March 2024, a district court in Alabama issued a final judgement enjoining enforcement of the Corporate Transparency Act against…

Read MoreStrategies to Help You Save Money and Reduce Taxes

By: Jennifer Pacilli, CPA, Director **Note: We’ve updated all financial references to tax years 2023 and 2024** The role of a certified public accountant has changed quite a bit from…

Read MoreRMD Relief and Guidance for 2023

In early 2022, the IRS issued proposed regulations regarding required minimum distributions (RMDs) to reflect changes made by the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019.…

Read MoreMarie Holliday Elected Chair of Delaware State Chamber of Commerce Board of Directors

It is with great pride and excitement that we share Marie Holliday, CPA, MBA, our managing director, has been elected as chair of the Delaware State Chamber of Commerce (DSCC)’s…

Read MoreEstate Taxes vs. Inheritance Taxes: Understanding the Differences

Estate and inheritance (“death”) taxes are levied on the transfer of property at death. The difference between an estate tax and an inheritance tax is based on who pays the…

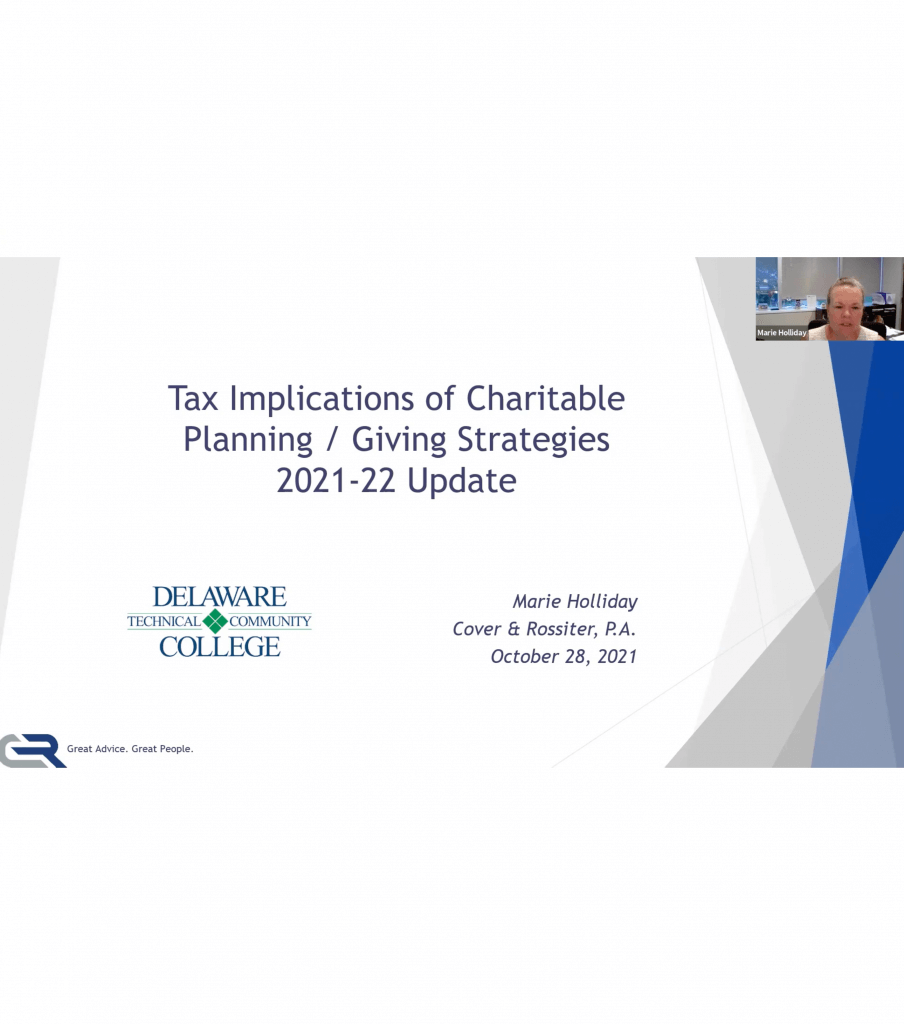

Read MoreTax Implications of Charitable Planning/Giving Strategies – Update for 2022/2023

By: Marie Holliday, CPA, MBA, Managing Director In late 2021, I presented “Tax Implications of Charitable Planning/Giving Strategies” to a DTCC virtual audience. The program gave an overview of changes…

Read MoreStrategies to help you save time, money and aggravation at tax time. [Updated Dec 2022]

By: Jennifer Pacilli, CPA, Director **Note: We’ve updated all financial references to tax years 2022 and 2023. The role of a certified public accountant has changed quite a bit from…

Read MoreSave Time, Money and Aggravation at Tax Time

By: Jennifer Pacilli, CPA, Director The role of a certified public accountant has changed quite a bit from when I first entered the profession. Today’s CPAs are advisors who assist…

Read MoreTax Implications of Charitable Planning/Giving Strategies

By: Marie Holliday, CPA, MBA, Managing Director On October 28, 2021, Managing Director Marie Holliday, presented a webinar on Tax Implications of Charitable Planning / Giving Strategies for Delaware Technical…

Read MoreTax Provisions of the American Rescue Plan Act (ARPA)

(March 18, 2021) The American Rescue Plan Act of 2021 (ARPA), which Congress passed and President Biden signed into law on Thursday, March 11, grants relief to taxpayers and extends…

Read More