TaxCaddy - Tax time simplified

TaxCaddy makes it easier than ever to gather your 1040 tax documents and share them with Cover & Rossiter. Let TaxCaddy retrieve your 1099s, 1098s and W-2s automatically. Upload or snap photos of your tax documents year-round and store them with bank vault security. Electronically sign your engagement letter and complete the tax questionnaire from anywhere. No more office visits. No more paper organizers. Download the TaxCaddy brochure for more information.

*Note: TaxCaddy is available at no charge to Cover & Rossiter 1040 clients only.

TaxCaddy Features and Benefits

Getting started is as easy as 1, 2, 3:

- Sign Up. If you haven’t already enrolled in TaxCaddy, send an email to intake@coverrossiter.com to request the link to enroll in TaxCaddy. From the email, click the Sign Up Free button. Create a password, select your three security questions, and follow the steps to create your TaxCaddy account.

- Connect. Log in to your TaxCaddy account and accept Cover & Rossiter’s connection request. Accepting the connection request allows Cover & Rossiter to send you messages and requests, see your tax documents, and send you the engagement letter to sign and tax questionnaire to complete online.

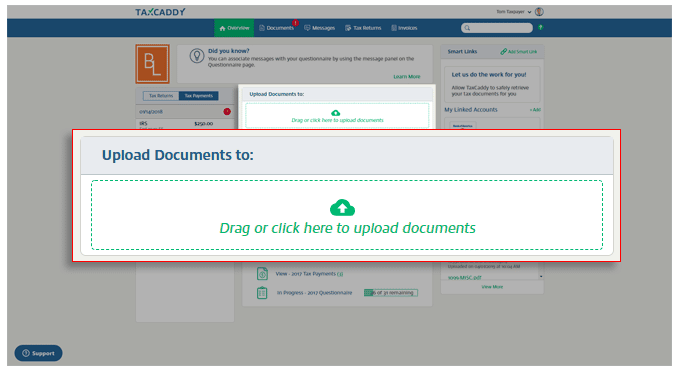

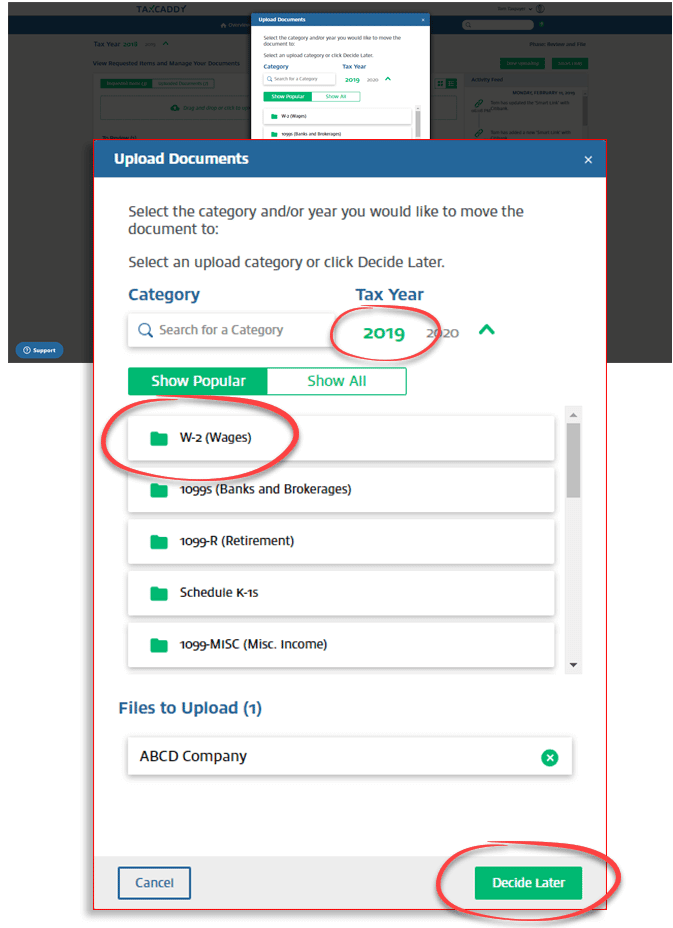

- Begin. Your spouse or a financial advisor can be added as an additional user and granted access to your TaxCaddy account at any time. Link to your banks and brokerages using the SmartLink feature and let TaxCaddy automatically retrieve your tax documents. Install the TaxCaddy app for iPhone or Android to take photographs of paper documents as you receive them.

Learn more at www.taxcaddy.com. For detailed instructions on getting started, visit the TaxCaddy Help Center. You may also call us at 302-656-6632 - ask to speak with one of our TaxCaddy specialists.