Great Advice Tailored to Your Needs

Delaware EARNS Program Kicks Off July 1st – Here’s What You Need to Know

Delaware EARNS – giving employees access to retirement savings programs.

Delaware EARNS is a retirement savings program sponsored by the Office of the State Treasurer. In…

Read More

Take Action Now to Reduce Your 2024 Tax Liability

Tax Tips From Cover & Rossiter

We are getting into the busy part of the 1040 tax filing season and even though you’re focused on getting your 2023 tax return filed,…

Read More

Corporate Transparency Act – Beneficial Ownership Reporting Requirements

Important information related to new beneficial ownership reporting requirements.

NOTE: In March 2024, a district court in Alabama issued a final judgement enjoining…

Read More

Update on the Employee Retention Credit (ERC)

Key observations and the IRS Voluntary Disclosure Program to return incorrect payments

By Pete Kennedy, CPA, Director

Background

The Employee Retention Credit (ERC)…

Read More

Strategies to Help You Save Money and Reduce Taxes

By: Jennifer Pacilli, CPA, Director

**Note: We’ve updated all financial references to tax years 2023 and 2024**

The role of a certified public accountant has changed…

Read More

RMD Relief and Guidance for 2023

In early 2022, the IRS issued proposed regulations regarding required minimum distributions (RMDs) to reflect changes made by the Setting Every Community Up for Retirement…

Read More

Take Action Now to Reduce Your 2023 Tax Liability

UPDATE: See our latest blog post “Take Action Now to Reduce Your 2024 Tax Liability” for the latest strategies on reducing your tax liability.

The end of the year is a…

Read More

Tax Implications of Charitable Planning/Giving Strategies – Update for 2022/2023

By: Marie Holliday, CPA, MBA, Managing Director

In late 2021, I presented “Tax Implications of Charitable Planning/Giving Strategies” to a DTCC virtual audience. The…

Read More

How to Inflation-Proof a Retirement Portfolio

To build a portfolio designed to provide inflation-adjusted income throughout a long retirement, consider the following tactics.

Read More

Sold Your Home Last Year or Plan to in 2023? If So, Here’s What You Need to Know

The U.S. housing market has been extremely volatile over the past year. Year-over-year growth rates were at highs of 20.1 percent in April 2022, then declined to only 8.6…

Read More

![Strategies to help you save time, money and aggravation at tax time. [Updated Dec 2022]](https://coverrossiter.b-cdn.net/wp-content/uploads/2021/12/WIB-final-image-title-1024x681-1.jpeg)

Strategies to help you save time, money and aggravation at tax time. [Updated Dec 2022]

By: Jennifer Pacilli, CPA, Director

**Note: We’ve updated all financial references to tax years 2022 and 2023.

The role of a certified public accountant has changed…

Read More

ERC – Too Good to be True?

The Employee Retention Credit is a legitimate program, but failure to apply the actual rules of the credit to applicants and their specific situation will result in inflated credit amounts which will, in all likelihood, need to be repaid.

Read More

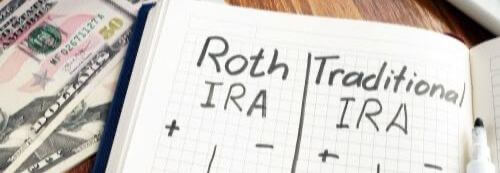

Deciding if a Roth IRA Conversion is For You

Roth IRAs can be a powerful tax tool, but they are often misunderstood and misused. Investment income in Roth IRAs compound tax-free and most distributions are tax-free as…

Read More

It’s National Tax Security Awareness Week – Tips to Stay Safe

Image source: HCAMag.com

On this Cyber Monday, as the IRS celebrates the 5th annual National Tax Security Awareness week, here are a few basic steps everyone should remember…

Read More

3 Big Tax Issues to Look Out For in Your Estate Plan

There are three big tax issues that can derail an otherwise well-executed estate plan. These include Family Limited Partnerships (FLPs), Revocable Trust Swap Powers and Trust…

Read More

Changes to Required Minimum Distributions

By: Mengjiao (Sherry) Yao, CPA, Supervisor

[Notice: Some of the information in this blogpost is no longer relevant. Click here to read our latest post for updates to the…

Read More

Roth Conversion – Should You or Shouldn’t You?

Factors to Consider if Converting from a Traditional IRA to a Roth

By: Kimberly Zarett, CPA, MS, Principal

2020 has certainly been a year unlike any other. In terms of…

Read More

Too Many Passwords to Remember? We’ve Got a Solution

By: Donna Bryant, C&R Administration and IT Manager

Those pesky passwords. The length, numbers, special characters, capital letters! According to a survey conducted by…

Read More

HSA Accounts and Their Incredible Long-term Benefits

Pretty much everyone has heard about 401(k) plans, but beyond these – Health Savings Accounts (HSAs) also can be great retirement vehicles. HSAs are tax-advantaged savings…

Read More

How We Help

Cover & Rossiter’s combination of technical expertise, value-based fees and unparalleled personal service makes us a great choice to work with our clients and their professional advisors. Our qualified team offers a wide range of trust and estate services. We work closely with banks, trust companies, and registered investment advisors and attorneys.

Our most requested services for fiduciary advisors include:

- Preparation of trust, estate, inheritance and gift tax returns

- Trust accounting

- Estate tax planning

- Estate and trust administration

- Trust Company services

Great People

Marie Holliday

Managing Director, CPA, MBA

Individuals & Families, Businesses, Fiduciary Advisors

Individuals & Families, Businesses, Fiduciary Advisors

Marie is responsible for the strategic direction of the firm as well as leading the firm’s tax and advisory services departments, which includes individuals and families, estates and trusts, and corporate clients. She takes a more holistic approach with her client, in that she focuses on the various stages of growth in one’s life or business to come up with tax planning strategies that influence long-term financial stability.

Andy Johnson

Principal, CPA

Individuals & Families, Businesses, Fiduciary Advisors

Individuals & Families, Businesses, Fiduciary Advisors

Andy’s attention to detail and problem solving ability have benefitted his clients as he assists them with navigating the constantly changing tax landscape. He is an exceptional writer and has the ability to take the most complex of tax laws and explain them in an easy-to-understand format.

Jennifer Pacilli

Director, CPA, CVA

Individuals & Families, Businesses, Fiduciary Advisors

Individuals & Families, Businesses, Fiduciary Advisors

Jennifer applies her expertise on many of the firm’s challenging and diverse corporate, individual and international clients. She has established a reputation for her strong attention to detail and her dedication to serving her clients.

Peter Hopkins

Principal, CPA

Individuals & Families, Businesses, Fiduciary Advisors

Individuals & Families, Businesses, Fiduciary Advisors

Peter assists a wide variety of clients. Industries he has served include both onshore and offshore hedge funds, broker/dealers and investment advisory firms. He has provided tax advisory, planning and compliance services for multinational corporations both publicly traded and closely held. He also has extensive experience with foreign-owned businesses operating in the United States.

Kim Zarett

Principal, CPA, MS

Individuals & Families, Businesses, Fiduciary Advisors

Individuals & Families, Businesses, Fiduciary Advisors

Kim has a broad tax background with a strong focus on tax planning for estates, trusts and high net worth individuals. Through the years, Kim has serviced clients working in many different sectors including real estate, medical/dental practices, and investment partnerships.