Corporate Transparency Act – Beneficial Ownership Reporting Requirements

Important information related to new beneficial ownership reporting requirements.

NOTE: In March 2024, a district court in Alabama issued a final judgement enjoining enforcement of the Corporate Transparency Act against two plaintiffs who challenged the constitutionality of the law. The Financial Crimes Enforcement Network (FinCEN), has not yet issued guidance addressing whether reporting beneficial information is still required. The judgement of the district court is subject to appeal, and the government has not indicated whether it intends to do so. You are advised to monitor developments pertaining to the reporting requirement, since the ultimate outcome is unpredictable.

By: Caren McCabe, MBA

Effective January 1, 2024, a significant number of businesses are required to comply with the Corporate Transparency Act (“CTA”), which was signed into law on January 1, 2021 as part of the National Defense Act. The CTA requires the disclosure of the beneficial ownership information (“BOI”) of certain entities from people who own or control a company doing business in the US.

It is anticipated that 32.6 million businesses will be mandated to comply with this reporting requirement. The intent of the BOI reporting requirement is to help US law enforcement combat money laundering, the financing of terrorism and other illicit activity.

The CTA is not a part of the tax code. Instead, it is a part of the Bank Secrecy Act, a set of federal laws that require record-keeping and report filing on certain types of financial transactions. Under the CTA, BOI reports will not be filed with the IRS, but with the Financial Crimes Enforcement Network (FinCEN), another agency of the Department of Treasury.

Filing is simple, secure, and free of charge. Additionally, beneficial ownership information reporting is not an annual requirement. Unless a company needs to update or correct information, a report only needs to be submitted once.

Below is information for you to consider in order to determine if your entity is subject to this new reporting requirement.

Who needs to report?

Both domestic and foreign reporting companies are required to file reports. A company is considered a “reporting company” if a document was filed with the secretary of state (SOS) or similar office to create or register the entity. Corporations (including S corporations), LLCs, and other entities formed through the SOS are subject to the reporting requirements.* But, because sole proprietorships, trusts, and general partnerships do not require the filing of a formal document with the SOS, they generally are not considered a reporting company and will not have a filing requirement.

[*Note: If you have an LLC that is holding a piece of property (for example – a vacation home with no business usage), you may not think you have a filing requirement because there is no separate tax filing requirement. If, however, the LLC was filed with the secretary of state or similar office, the LLC is subject to the BOI filing requirement.]

Foreign companies are required to report under the CTA include corporations, LLCs or any similar entity that is formed under the law of a foreign country and registered to do business in any state or tribal jurisdiction by filing a document with the SOS or similar office under state law.

Who does not need to report?

There are 23 categories of exemptions. Included in the exemptions list are publicly traded companies, banks and credit unions, securities brokers/dealers, public accounting firms, tax-exempt entities, and certain inactive entities, among others. Please note these are not blanket exemptions and many of these entities are already heavily regulated by the government and thus already disclose their BOI to a government authority.

In addition, certain “large operating entities” are exempt from filing. A large operating entity is any entity with (a) more than 20 full-time US employees, (b) an operating presence at a physical office within the US, and (c) more than $5,000,000 of US-sourced gross receipts reported on its prior year federal income tax return. If you meet these qualifications, you are not subject to the new reporting requirements.

Who is a beneficial owner?

Any individual who, directly or indirectly, either: (1) Owns or controls at least 25 percent of the ownership interests of a reporting company; or (2) Exercises “substantial control” over the reporting company.

Individuals with substantial control are those with substantial influence over important decisions about a reporting company’s business, finances, and structure. Senior officers (president, CFO, general counsel, CEO, COO, and any other officer who performs a similar function) are automatically deemed to have substantial control, as are individuals with the authority to appoint or remove senior officers and board members. There is no requirement that these individuals have actual ownership in the company to be considered a beneficial owner for reporting purposes.

Important filing dates

Compliance with the CTA depends on whether a reporting company was formed prior to or after the effective date of January 1, 2024:

- If your company already exists as of January 1, 2024, it must file its initial BOI report by January 1, 2025.

- If your company is created or registered to do business in the United States on or after January 1, 2024, and before January 1, 2025, it will have 90 calendar days after receiving actual or public notice that the company’s creation or registration is effective to file its initial BOI report.

- If your company is created or registered on or after January 1, 2025, it will have 30 calendar days from actual or public notice that its creation or registration is effective to file its initial BOI report.

- If your company previously qualified for an exemption to the reporting company definition but no longer qualifies, you are required to fil a BOI report within 30 calendar days of the date on which your company stops qualifying for the exemption.

If there is any change to the required information about your company or its beneficial owners in a previously-filed BOI report, your company must file an updated BOI report no later than 30 days after the date on which the change occurred.

Penalties for non-compliance

It is imperative that your company file the initial report when required. Furthermore, your company should implement a system to identify reportable changes and file an updated report with FinCEN in a timely manner. Failing to comply with the reporting requirements can result in penalties for the reporting company, senior officers of the reporting company, and beneficial owners. The penalties for willfully failing to file both initial and updated reports are steep – $500 per day that the report is late, up to $10,000 and imprisonment for up to two years.

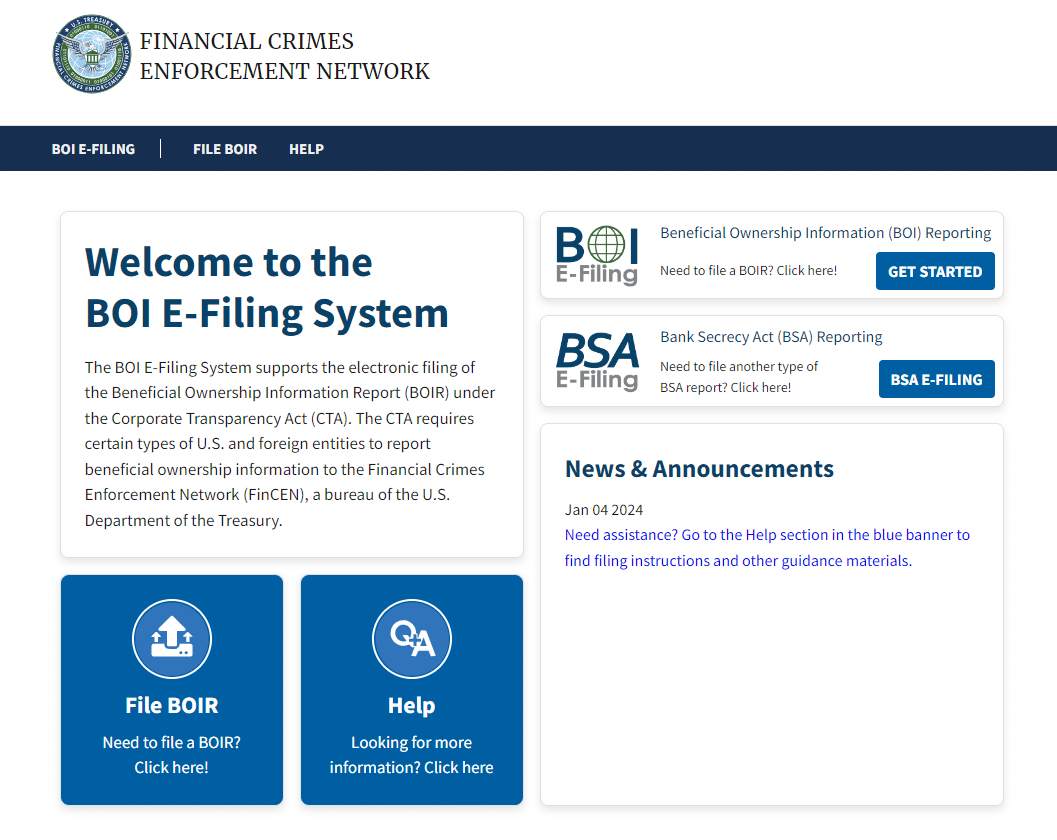

How to file a BOI report

If you are a “reporting company” and therefore required to file a BOI report, you must do so electronically through a secure filing system (https://boiefiling.fincen.gov). There are to methods to submit a report: (1) by filling out a web-based version of the form and submitting it online, or (2) by uploading a completed PDF version of the BOI report. The person who submits the BOI report will need to provide their name and email address to FinCEN. There is no fee for filing the report.

Also, you are not required to use an attorney or certified public accountant (CPA) to submit beneficial ownership information to FinCEN. FinCEN expects that many, if not most, reporting companies will be able to submit their beneficial ownership information to FinCEN on their own. Reporting companies that need help meeting their reporting obligations can consult with professional service providers such as lawyers or accountants.

For more information

Cover & Rossiter will not be providing services related to BOI reporting. If you have any questions about these new reporting rules, how they affect your business, and how to file, FinCEN has a Small Entity Compliance Guide and frequently asked questions to help guide businesses through the reporting requirements. These are available at https://www.fincen.gov/boi/small-business-resources.

If you have a complicated business structure, e.g. multiple entities that own other entities, or foreign-owned entities, we suggest you contact your attorney for assistance. There are also companies that can assist with filing. One that we are aware of is: https://www.wolterskluwer.com/en/know/beneficial-ownership-information-reporting.