Hopefully you are enjoying your summer, and are relieved that your 2011 tax returns have been filed. Planning for your 2012 taxes probably seems like the least of your concerns right now. Normally, you do not begin that planning process until closer to year end. That may have been an acceptable approach in prior years; however, this year looming on the horizon are significant changes in tax law as well as pending tax law changes that could have an impact on your tax liabilities. These changes are among the most comprehensive changes that U.S. taxpayers have seen in a long time. Cover & Rossiter wants to keep you informed of these changes and assist you in determining any potential effect these changes will have on your tax situations.

-

Stay informed of the tax law changes approaching

-

Health Care Tax Act and Its Impact on Taxpayers

-

Individual Tax Rates Will Increase As “Bush tax cuts” Expire

-

Health Care Coverage Requirements and Reporting

-

Itemized Deductions and Personal Exemptions

Stay informed of the tax law changes approaching.

Over the next several weeks we will be providing our clients with weekly emails outlining some of the pending and recently enacted tax law changes, such as:

- The .9% Medicare surtax on individuals earning wages more than $200,000 per year ($250,000 for married couples).

- The 3.8% Medicare surtax on net investment income for individuals with adjusted gross income greater than $200,000 ($250,000 for married couples).

- Reversion back to the “pre- Bush” individual tax rate brackets of 15, 28, 31, 36 and 39.6 percent tax brackets (currently the tax brackets are 10, 15, 25, 28, 33 and 35 percent).

- Expiration of the “Bush tax cuts” on dividend and capital gain income. Presently, the rates on qualified dividends and long term capital gains are 15%. If legislation is not passed these rates will jump as high as 39.6% for dividends and 20% for long-term capital gains. Adding on the Medicare surtax for investment income, the amounts could be as high as 43.4% and 23.8%, respectively.

- Reduction in the amounts allowed for medical flexible spending accounts to a $2,500 annual cap.

- Requirement for many businesses to report on an employee’s W-2 the cost of employer-sponsored health care coverage.

- Expiration/reduction in bonus and Section 179 depreciation as well as pending legislation to reinstate those provisions for 2013.

- Increased FUTA tax rates in certain states due to the depletion of state unemployment coffers which resulted in loans from the federal government. Employers in states that have not repaid those loans will incur higher FUTA taxes.

In addition, Cover & Rossiter will be holding seminars at both our Wilmington and Middletown offices to explain in more detail these changes and answer questions you may have. The dates of these seminars are as follows:

Wilmington office: September 25th 8:00 AM

October 23rd 5:30 PM

Middletown office: October 2nd 5:30 PM

Please feel free to contact Marie Holliday at (302) 691-2211 if you have any additional questions.

To register for a seminar click here or call 302.691.2224.

Health Care Tax Act and Its Impact on Taxpayers

The Patient Protection & Affordable Care Act, which is referred to as “Obama Care“, was signed into law by Barack Obama on March 23, 2010. This Act was designed to overhaul the U.S. healthcare system by providing affordable health care coverage to all Americans. Since its passage there has been significant opposition to the Act but just recently, the Supreme Court upheld the constitutionality of the legislation. Funding for this Act will come mainly in the form of Medicare surtax on upper income taxpayers as follows:

- Beginning in 2013, there is an additional .9% Medicare tax for high income earners. The self employment or wages of single taxpayers in excess of $200,000 and married taxpayers (filing jointly) in excess of $250,000 will be subject to the additional tax.

- Beginning in 2013, there is an additional 3.8% Medicare tax on unearned income such as interest, dividends, capital gains, annuities, royalties, and rent. Single taxpayers with earnings over $200,000 and married taxpayers with earnings over $250,000 will be subject to the additional tax. This provision is significant since it is the first time that the federal government has assessed Medicare tax on unearned income. Tax exempt interest and income from retirement accounts are exempt from this surtax.

Additional other taxes and limitations on deductions will apply as well. Some of these changes are listed below:

- Beginning in 2013, all flexible spending account contributions are reduced to a $2,500 maximum limit.

- Beginning in 2013, all qualified out of pocket medical expenses must exceed 10% of an individual’s adjusted gross income in order to receive a deduction on their tax return (presently the threshold is 7.5%). Taxpayers over 65 years old are subject to the 7.5% limit through 2016.

- Penalties will increase to 20% for any non-medical distributions from a Health Savings Account.

These tax law changes can have a significant impact on the amount of tax each individual will owe in the 2013 tax year.

If you have any questions or are interested in learning how these changes will affect your 2013 tax liability, please contact Jennifer Pacilli at 302.691.2204 or by email.

In addition, Cover & Rossiter will be holding seminars at both our Wilmington and Middletown offices to explain in more detail these changes and answer questions you may have. The dates of these seminars are as follows:

Wilmington office: September 25th 8:00 AM

October 23rd 5:30 PM

Middletown office: October 2nd 5:30 PM

To register for a seminar click here or call 302.691.2224.

Individual Tax Rates Will Increase As “Bush tax cuts” Expire

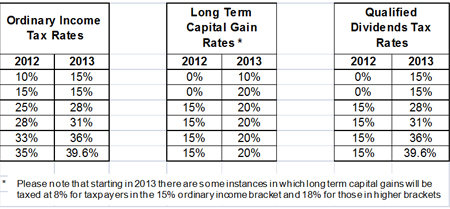

Unless legislation is passed within the next few months, the “Bush tax cuts” will expire at the end of 2012, and the individual tax rates will increase across the board for 2013 as follows:

As you can observe from the table above, all taxpayers will experience an increase in their effective federal tax rates, not just higher income individuals.

- Lower income taxpayers’ ordinary federal rates will increase 50% from 10% to 15%, and those in the highest tax bracket could see an ordinary tax rate increase from 35% to 39.6%.

- Taxpayers in the lower income tax brackets have not paid taxes on their long term capital gains over the past several years, but starting in 2013 their rates will increase to either 10 or 20%. Taxpayers in the remaining tax brackets will see a 33.3% increase in their long term capital gains tax rates starting in 2013.

- Qualified dividends will no longer receive a preferential reduced tax rate and will be taxed at ordinary income tax rates.

Many of the higher income taxpayers will also be subject to the additional Medicare surtax of 3.8% on their investment income (capital gains, dividends, and other investment related income types) effectively increasing their ordinary income tax rate to 43.4% and long term capital gain rate to 23.8%. The tax experts at Cover & Rossiter expect that legislation will be enacted to prevent or diminish the impact of these changes; however, we do not expect such legislation to be passed until after the elections. In addition, the proposals currently being presented may only diminish the impact for taxpayers whose income is less than $250,000.

If you have any questions or would like more information, please contact Diane Burke at (302) 656-6632.

Cover & Rossiter will be holding seminars at both our Wilmington and Middletown offices to discuss these changes and offer strategies for being proactive in 2012. The dates of these seminars are as follows:

Wilmington office: September 25th 8:00 AM

October 23rd 5:30 PM

Middletown office: October 2nd 5:30 PM

To register for a seminar click here or call 302.691.2224.

Health Care Coverage Requirements and Reporting

The Supreme Court recently upheld the provisions of the 2010 Patient Protection & Affordable Care Act. As a result it will become mandatory for many employers to provide medical coverage to their employees in 2014. Outlined below are some of the rules:

- Companies with 50 or more full-time employees must provide health insurance for all workers by 2014 or penalties could be imposed

- The individual mandate states that everyone must purchase some sort of health insurance by 2014. That means at companies with fewer than 50 employees the responsibility will be on the employee to obtain medical coverage if the employer does not provide it.

- Sole proprietors will also be required to buy health insurance for themselves in 2014 or pay a fine

- The plan must cover 60% of health care expenses

- The employee’s share of the insurance costs must be less than 9.5% of the family’s salary

- Stiff penalties will apply for those who don’t comply with the mandate, including:

o Individuals without health coverage will be fined a minimum of $95 or 1% of their income starting in 2014 and the penalties increase each year after.

o Employers who don’t meet health insurance coverage requirements could face a minimum penalty of $40,000

In addition, employers are now subject to additional reporting requirements for employer-sponsored health coverage. The Act requires employers to report to their employees on Form W-2 the cost of employer-provided health insurance. Listed below are some guidelines:

- This reporting requirement is optional for small-employers filing less than 250 Forms W-2 in 2012

- In 2013 it will be mandatory for all employers to report the cost of health care premiums to employees.

- The aggregate cost of employer-sponsored health coverage is reported on Box 12 using code DD on Form W-2.

- Please be aware that if you have a payroll agent preparing Forms W-2 for your business you will need to provide the amount of employer-sponsored health coverage for each employee to the payroll agent in order for the correct costs to be included on the employee’s Form W-2.

If you have any questions or would like more information, please contact Rachael Leberstien at 302.691.2237 or by email. Visit our website for more information about our firm and the services we provide.

Cover & Rossiter will be holding seminars at both our Wilmington and Middletown offices to discuss these changes and offer strategies for being proactive in 2012. The dates of these seminars are as follows:

Wilmington office: September 25th 8:00 AM

October 23rd 5:30 PM

Middletown office: October 2nd 5:30 PM

To register for a seminar click here or call 302.691.2224.

Itemized Deductions and Personal Exemptions

Over the past several weeks Cover & Rossiter has been alerting clients of the myriad of tax law changes set to take place in January 2013. This week’s tax planning tips will focus on changes that are scheduled to occur for itemized deductions and personal exemptions as well as some proposed changes that are being debated. Some upcoming changes are as follows:

- There will be a return to the “phase-out” of itemized deductions to the extent your AGI (adjusted gross income) exceeds a certain threshold. Therefore, 3% of the amount that exceeds this threshold will reduce your allowable itemized deductions.

- The “phase-out” of personal exemptions will be reinstated as well. Personal exemptions would be reduced 2% for each $2,500 by which the taxpayer’s AGI exceeds a certain threshold amount. The deduction for the personal exemption would be completely eliminated at approximately $175,000 for single taxpayers and $260,000 for married couples filing a joint return.

- Mortgage insurance premiums will no longer be deductible. (There presently is legislation pending which would extend the ability to deduct this expense).

- Medical expenses will be deductible as an itemized deduction to the extent those expenses exceed 7.5% of a taxpayers’ AGI. Starting in 2012 the threshold increases to 10% of AGI. However, taxpayers who are 65 or older before January 1, 2013 will continue to be able to deduct their medical expenses to the extent the expenses exceed 7.5% for the taxable years 2013 through 2016.

Proposals for tax changes:

- There have been discussions by both political parties in favor of eliminating the mortgage interest deduction on homes that are not the primary residence of a taxpayer. Presently, there is no actual bill, but since there seems to be bipartisan support C&R wants to inform you of this possibility. Taxpayers who are considering purchasing a vacation home, and are counting on a taxable mortgage interest deduction should factor in to their decision making process that the deduction may not be available long term.

- There have been discussions regarding the limitation of the charitable deduction for upper income taxpayers. The Obama proposal would limit the value of the itemized deduction to 28% for couples with incomes greater than $250,000 and individuals with incomes greater than $200,000. Although this has been proposed previously C&R does not believe that there is a high likelihood of legislation passing Congress due to large opposition by non-profit organizations.

Higher income taxpayers should consider pre-paying any itemized deductions such as mortgage interest, real estate taxes and charitable contributions in 2012 to take advantage of the opportunity to obtain a full taxable deduction for those expenses. These decisions can be complicated so please contact us so that we can advise you appropriately on what strategy works best for your situation.

Please feel free to contact Marie Holliday at (302) 691-2211 or Jeff Willis at (302) 691-2218 if you have any additional questions.

Cover & Rossiter will be holding seminars at both our Wilmington and Middletown offices to discuss these changes and offer strategies for being proactive in 2012. The dates of these seminars are as follows:

Wilmington office: September 25th 8:00 AM

October 23rd 5:30 PM

Middletown office: October 2nd 5:30 PM

To register for a seminar click here or call 302.691.2224.