By: Pete Kennedy, CPA, Director

“How do I start a nonprofit?” is a question I get asked with some frequency and the answers might not be what you expect. If you are considering starting a nonprofit, there are a number of factors to consider. We’ve put together a four-part series of posts and accompanying videos to provide you with a baseline of information as it relates to key considerations to setting up a nonprofit, steps to setting up a nonprofit, selecting the appropriate tax exempt status, and, finally, obtaining exempt status.

Part 3: Understanding Nonprofit Tax Exempt Status Types

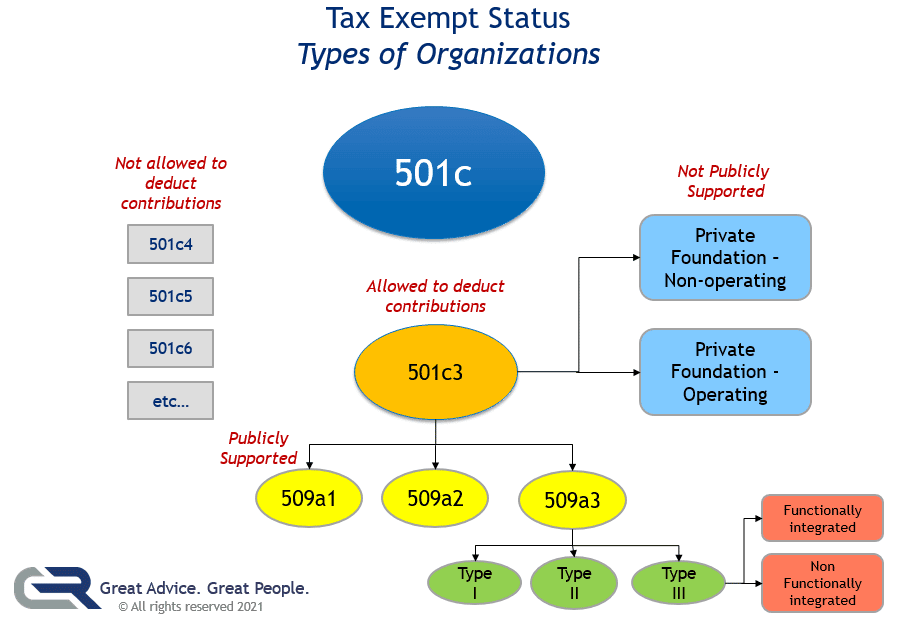

Before discussing how to apply to the IRS for tax-exempt status, let’s first look at the tax exempt status types. 501c is the tax code section and under 501c there are different sub-sections as noted in the chart below:

Generally speaking, most nonprofits want to form a 501c(3) publicly-supported organization. An organization under 501c(3) does not pay tax on its own income. It can also accept tax deductible contributions from donors.

There are number of different types of organizations under 501c(3). Private Foundations fall under 501c(3). They are the least favorable type of 501c(3) organization because they are not publically supported. Private foundations typically have a single major source of funding (usually gifts from one family or corporation rather than funding from many different sources) and most have as their primary activity the making of grants to other charitable organizations and to individuals, rather than the direct operation of charitable programs.

Publically supported 501c(3) organizations include the following status types:

- 509a(1) are supported by public contributions. This is the most common type and the most advantageous.

- 509a(2) are generally supported by program service revenues.

- 509a(3) are supporting organizations that exist to support another publicly supported organization, e.g., separate fundraising arm of an organization.

An organization is a publicly supported charity if it meets one of two tests:

- The organization receives a substantial part of its support in the form of contributions from publicly supported organizations, governmental units, and/or the general public. For example, a human service organization whose revenue is generated from widespread public fundraising campaigns, federated fundraising drives, or governmental grants is a publicly supported charity.

- The organization receives no more than one-third of its support from gross investment income and more than one-third of its support from contributions, membership fees, and gross receipts from activities related to its exempt functions. For example, a membership-fee organization, such as parent-teacher organization, or an arts group with box office revenue is a publicly supported charity.

Source: irs.gov/charities-non-profits/charitable-organizations/publicly-supported-charities

In addition, all supporting organizations must pass an organizational test, an operational test, a control test and a relationship test. Supporting organizations are classified as Type I, Type II or Type III supporting organizations based on how they satisfy the relationship test. For more information, visit irs.gov / Supporting Organizations – Requirements and Types.

Other 501c organizations are not allowed to deduct contributions from donors. This includes:

501c(4) pertains to Civic Leagues, Social Welfare Organizations, and Local Associations of Employees.

501c(5) pertains to Labor, Agricultural, and Horticultural Organizations.

501c(6) pertains to Business Leagues, Chambers of Commerce, Real Estate Boards, etc.

Which tax exempt status should you choose?

Assuming you want to be a publicly supported 501c(3) organization, the answer depends entirely on your mission and how the organization will be funded. The IRS wants to be sure the organization exists to benefit the public at large and not just a small number of individuals. In order to do that in a way that is measurable, the IRS has devised public support tests. The mechanics of the calculation are slightly different for 509a(1) and 509a(2) organizations. 509a(1) will favor large numbers of small charitable contributions, while 509a(2) allows you to count service fees as a means of funding. You want to be sure that you pass the public support tests on an ongoing basis.

Other topics covered in this four-part series:

Part 1: Key Considerations to Setting Up a Nonprofit

Part 2: Steps to Setting up a Nonprofit

Part 4: Obtaining Tax Exempt Status

Pete Kennedy is a Director at Cover & Rossiter and is one of the leaders of our Audit practice. He has developed an expertise in nonprofit accounting, auditing and tax issues and is privileged to work with many of the region’s leading institutions.