By: Tina Truby, CPA, Supervisor

NOTE: THIS POST WAS UPDATED JAN-2024.

Check out our corresponding video

Recently, a client contacted us with a question. “I’m a partner in a design business and we’ve not had the office open at all during the COVID-19 pandemic. I’ve been working from my home office now for over 4 months – Am I eligible for the Home Office deduction?”

We’re glad you’re asking this question and that you’ve started thinking about your 2020 tax filing. There’s no need to tell you that change is constant these days. And that’s especially true with tax law, and, in many areas, like the home office deduction, one answer most certainly does not fit all.

With the current tax law, there may be some good news we can share. Let’s take a closer look at some of the key points to applying the home office deduction:

Who is eligible to take the home office deduction?

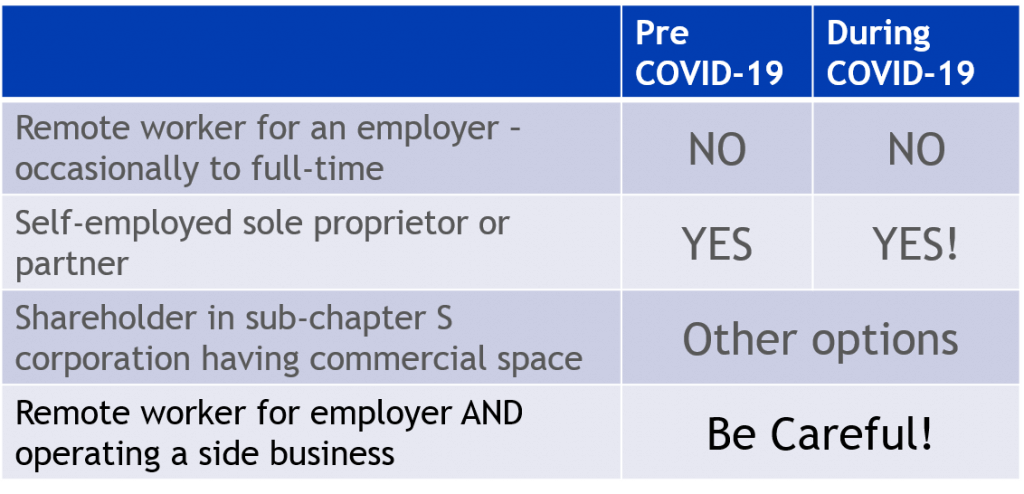

While there have been no specific COVID pandemic-related changes in the tax law, specific changes in working situations may still have an impact on eligibility. We’ll go through a few scenarios to help explain.

Let’s start with if you are an employee, that is, someone who receives a W-2 at year-end. If you work from home, either occasionally or maybe even full-time, YOU DO NOT QUALIFY for a home office expense deduction. Period.

If you are a self-employed sole-proprietor or partner and work primarily out of your home or conduct the administrative piece of your business from your home – YES, you are eligible to take the deduction. That was true before the pandemic and becomes even more important for you to take advantage of now as you try to further minimize your costs during these times of unexpected revenue loss.

Additionally, as you know, with COVID-19 came government mandates for closing many places of business that were not considered essential. This situation provides additional opportunity to pursue use of the home office deduction for those in this category who would otherwise normally be working in commercial office space and CANNOT access that commercial office space.

One key piece of advice we will share with ANYONE considering taking the home office deduction is … KEEP GOOD RECORDS!

If you are a shareholder in an S Corporation and you receive both W-2 wages AND K-1 distribution of profit, there are options outside of the home office deduction for handling the costs of a qualifying home office through use of an accountable plan.

The last scenario is a hybrid, and one that may be more common during the pandemic. That is, you may be an employee, now working from your home and, in addition, you may also have your own business that you run from your home. In that case you may be already familiar with using the home office deduction. However, be careful as it will be especially important for you to keep good records.

The chart below summarizes eligibility criteria:

Criteria to consider for the home office deduction

There are two key criteria for determining your eligible home office space and they focus on the definitions of exclusive use and regular use.

First, the area you are calling your home office for the purpose of taking the home office deduction, has to be very specific. It must be an area of your home that is used exclusively for business. That means, it cannot be a dual-purpose area; or one that you might use for both business and personal purposes. Said another way, the space must be a designated space and have no other use – not a corner of your bedroom, not the dining room table, and not an occasionally-used guest room. That said, you can cordon off an area within a larger room, IF YOU ONLY USE THAT SPACE FOR BUSINESS AND IT IS SEPARATELY IDENTIFIABLE.

Remember the hybrid category of an employee working from home who also has a side business? If this describes you, make sure that your remote-employee workspace does not use the same workspace for which you wish to claim home office deduction for your side business.

To summarize, if you think your space DOES qualify – keep good records. Write down the exact description of your home office space, with measurements, and keep that file or piece of paper with your tax accounting records.

Second, the area that is your home office must be the principle place of business. Easiest to consider here is that your home office should at least be the place you use for administrative or management activities regularly, not just occasionally. Remember, maintaining accurate records is key to avoiding IRS scrutiny.

How do you calculate the home office deduction?

Depending on your circumstances, this question can get quite complex. As said previously, one answer does not fit all and you should ultimately discuss with your tax advisor or visit the resources you can find at IRS.gov.

There are two methods for considering your home office expenses – the Regular or Actual Expense method and the Simplified method.

The REGULAR or ACTUAL EXPENSE method typically uses the percent square footage of your designated office space as compared to that of your entire home. That percentage is then applied to actual expenses such as mortgage interest, real estate tax, insurance, repairs, utilities, etc.

AND, if you fall into the category created by the COVID-19 government stay-at-home mandate, are a sole proprietor or a business partner that operates out of a commercial space that was shut down, then you also need to prorate your expenses based on the number of days that the regular office space was inaccessible.

The SIMPLIFIED option uses a prescribed rate of $5 dollars times the qualified area, up to a maximum of 300 sq.ft. It is also pro-rated for number of days used and is an annual election that you must make on Schedule C of your tax return.

Learn more on our YouTube channel

Need more information?

Contact your Cover & Rossiter tax advisor or go to IRS.gov and search Home Office Deduction, or look for Topic No. 509, “Business Use of Home”, and Publication 587.

Tina M. Truby CPA is a Supervisor in Cover & Rossiter’s Tax Department. She joined the firm in 2017. Contact Tina at 302-656-6632 x246 or email TTruby@CoverRossiter.com