Financial Tips

Strategies to help you save time, money and aggravation at tax time. [Updated Dec 2022]

By: Jennifer Pacilli, CPA, Director **Note: We’ve updated all financial references to tax years 2022 and 2023. The role of a certified public accountant has changed quite a bit from…

Read More5 Tips for Job Seekers Over 50

You’ve got loads of experience in your field. You know things that only time can teach you. However, all of your experience and knowledge can sometimes work against you. And…

Read MoreStrategies for Paying Off Student Loans

Today, 70 percent of college students graduate with an average of $30,000 in student loan debt. The average payment is nearly $400 a month and will take about 20 years…

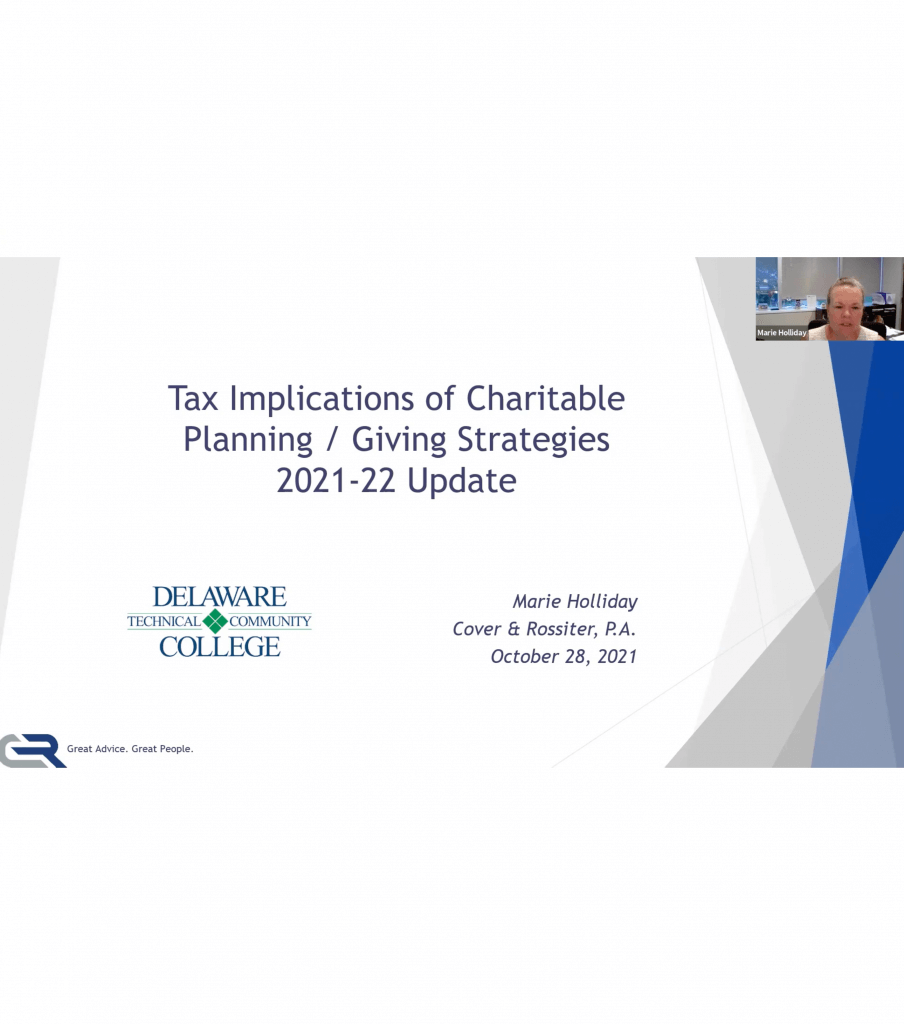

Read MoreTax Implications of Charitable Planning/Giving Strategies

By: Marie Holliday, CPA, MBA, Managing Director On October 28, 2021, Managing Director Marie Holliday, presented a webinar on Tax Implications of Charitable Planning / Giving Strategies for Delaware Technical…

Read MoreHow to Turn a Summer Job into a Tax-Free Retirement Nest Egg and More

‘Tis the season for summer jobs for high school and college kids. These seasonal jobs are more than just an opportunity for teens and college students to earn some money…

Read MoreFinancial Tips for Recent College Graduates

Members of the college graduating class of 2017 owed an average of close to $30,000 each in student loan debt. Imagine starting out adult life with that kind of debt…

Read MoreReal Estate Opportunities in 2021

Real estate has had a banner year as mortgage rates continue to be low, more people are looking to buy than those who are selling and home prices continue to…

Read MoreTax Provisions of the American Rescue Plan Act (ARPA)

(March 18, 2021) The American Rescue Plan Act of 2021 (ARPA), which Congress passed and President Biden signed into law on Thursday, March 11, grants relief to taxpayers and extends…

Read MoreImpact of COVID-19 on 2020 Taxes – Are You Ready?

By: Kimberly Zarett, CPA, MS, Principal COVID-19 has had a tremendous impact on businesses, our social interactions, and the economy. There have been several important legislative changes enacted this year,…

Read MoreTop 6 Year-End Tax Planning Tips

This has been a year of economic and tax uncertainty with the impact of the COVID-19 pandemic, potential stimulus bills, and the presidential election. As a result, tax planning may…

Read More